A pair of settlements totaling $229.5 million and a newly filed lawsuit against online retailers make clear that companies must use caution when leveraging comparative pricing practices to attract customers.

Online retailer Boohoo and its subsidiaries Nasty Gal and PrettyLittleThing (collectively, “Boohoo”) recently agreed to pay $197 million to resolve a nationwide class action and $32 million to settle three proposed California class actions against the companies. In each case, plaintiffs alleged that Boohoo tricked consumers into believing they were receiving significant discounts on items labeled as on sale (e.g., “50% Off Everything”) when, in fact, the items were almost always offered at the discounted rate and rarely sold at the reference price. Under the settlements, each class member will receive a $10 Boohoo gift card and free shipping. The $32 million settlement also requires that Boohoo permanently provides to California-based visitors to its websites a disclosure that Boohoo’s reference prices are not based on former prices and are merely Boohoo’s own opinion of the full retail value of the item. They will need to present that disclosure in bold font on any Boohoo webpage that advertises a reference price and discount price.

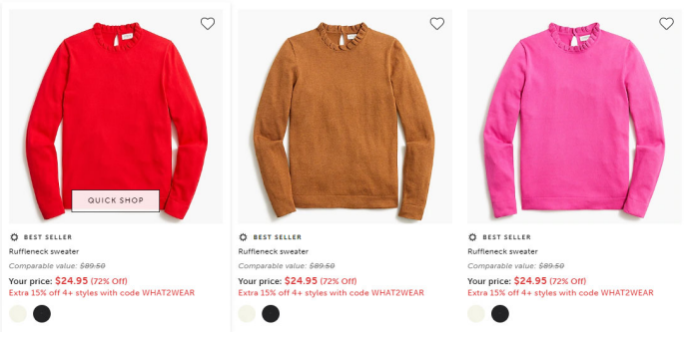

Separately, a recently filed class action lawsuit against J. Crew also emphasizes the risks of “comparable value” prices that may mislead or deceive customers into believing they are getting a bargain. According to the complaint, J. Crew and J. Crew Factory sell similar clothing, with the material differences being that J. Crew’s clothing is of a higher price and quality than the Factory brand clothing. However, plaintiffs allege the company deceives customers into believing that they are getting a bargain on Factory brand clothing by listing a “comparable value” price that references the price of J. Crew’s higher quality products. Plaintiffs assert that this falsely insinuates that the products are the same quality, and that the customer is getting a discount (see image below). Plaintiffs allege that J. Crew’s practices constitute unfair and deceptive trade practices, false advertising, unfair competition, fraud, and unjust enrichment under California law, and seek monetary damages (including punitive damages) and injunctive relief.

These latest cases add to the list of enforcement actions brought against online and brick-and-mortar retailers for their comparative pricing practices. In 2021, Amazon agreed to pay $2 million to settle claims brought by California district attorneys alleging that Amazon listed reference prices referring to former prices that were offered for only limited periods and insufficient sales were made at those prices. Overstock.com settled another case brought by California district attorneys, agreeing to pay $6.8 million to resolve claims that the company fabricated reference prices and did not verify that other retailers had made any substantial sales at comparison prices that Overstock listed on its website.

These cases signal that companies should evaluate whether their pricing practices comply with pricing and consumer protection laws in each jurisdiction where they operate. In addition to the risk of common law claims, retailers must also comply with California’s false advertising law imposing specific requirements on former prices (Cal. Bus. & Prof. Code § 17501) and applicable federal regulations. In particular, companies should:

Accurately represent the savings and discounts they are offering and display the savings, reference price, and sales price in understandable ways in advertisements and at the point of sale.

- Avoid inflating the prices of products for the sole purpose of later marking them down at a discounted sales price.

- Assess whether local laws set obligations and limits on what price may be listed as a reference price (which may be based on the duration of time that price was used, the amount of time that has passed since that price was offered, and the number of sales made at that price).

- Evaluate the transparency of its reference price calculations.

- Adopt methods for verifying that other retailers have made substantial sales at the reference price, as applicable.